The Importance of Due Diligence in Property Transactions

Due diligence in property transactions is your shield against fraud, legal complications, and financial losses. In Hyderabad's dynamic real estate market, thorough due diligence is not just recommended—it's essential for protecting your investment and ensuring a smooth transaction.

What is Property Due Diligence?

Property due diligence is a comprehensive investigation and verification process that examines all aspects of a property transaction before completion. It involves legal, technical, financial, and regulatory verification to ensure the property is free from encumbrances and suitable for purchase.

Components of Due Diligence

- Legal Due Diligence: Title verification, ownership confirmation, and legal compliance

- Technical Due Diligence: Structural assessment, systems evaluation, and quality verification

- Financial Due Diligence: Price verification, tax status, and financial obligations

- Regulatory Due Diligence: Approvals, clearances, and compliance verification

Legal Due Diligence: The Foundation

Title Verification Process

Title verification is the cornerstone of legal due diligence:

- Chain of Title: Tracing ownership history for at least 30 years

- Root of Title: Identifying the original source of ownership

- Encumbrance Certificate: Verifying all registered transactions

- Survey Settlement Records: Confirming land records and boundaries

Document Verification Checklist

Essential documents that require verification:

- Original sale deed and previous title documents

- Khata and property tax records

- Survey settlement records and pahani

- Mutation records and revenue records

- Power of attorney documents (if applicable)

- Legal heir certificates (for inherited properties)

Common Legal Issues in Hyderabad

Specific challenges in the Hyderabad market:

- Agricultural Land Conversion: Verification of proper conversion procedures

- Layout Approvals: DTCP approval for plotted developments

- Waqf Properties: Special considerations for Waqf board properties

- Government Land: Issues with properties on government or survey land

Technical Due Diligence: Ensuring Quality

Structural Assessment

Professional evaluation of the property's physical condition:

- Foundation Analysis: Checking for stability and structural integrity

- Construction Quality: Evaluating materials and workmanship

- Safety Standards: Compliance with building codes and safety norms

- Age Assessment: Determining actual age and remaining useful life

Systems Evaluation

Critical infrastructure systems assessment:

- Electrical systems and safety compliance

- Plumbing and water supply systems

- HVAC and ventilation systems

- Fire safety and emergency systems

- Elevator and mechanical systems (for apartments)

Environmental Factors

Environmental considerations specific to Hyderabad:

- Soil conditions and stability

- Drainage and flood risk assessment

- Air quality and pollution levels

- Noise pollution from traffic or industry

- Proximity to hazardous installations

Financial Due Diligence: Protecting Your Investment

Price Verification

Ensuring fair market value:

- Comparative Market Analysis: Comparing with similar properties

- Professional Valuation: Independent valuer assessment

- Market Trends: Understanding local market dynamics

- Future Potential: Growth prospects and appreciation potential

Financial Obligations Assessment

Identifying existing financial liabilities:

- Outstanding property taxes and penalties

- Utility bills and maintenance charges

- Mortgage or loan obligations

- Society dues and special assessments

- Legal costs and pending litigation expenses

Tax Implications

Understanding tax obligations:

- Stamp duty calculations and payments

- Registration fees and charges

- Capital gains tax implications

- Property tax assessments

- TDS requirements and compliance

Regulatory Due Diligence: Compliance Verification

Building Approvals and Clearances

Essential regulatory approvals:

- GHMC Approvals: Building plan approval and occupancy certificate

- DTCP Approval: For plotted developments and layouts

- HMDA Clearance: For properties in HMDA jurisdiction

- Environmental Clearance: For large projects and sensitive areas

- Fire Safety: NOC from fire department for high-rise buildings

RERA Compliance

Real Estate Regulatory Authority compliance:

- RERA registration status of the project

- Compliance with RERA disclosure requirements

- Carpet area calculations and verification

- Timeline commitments and penalties

- Escrow account maintenance

Due Diligence Process: Step by Step

Phase 1: Initial Assessment (Week 1)

- Basic document collection and review

- Preliminary title search

- Property visit and initial inspection

- Market research and price analysis

Phase 2: Detailed Investigation (Weeks 2-3)

- Comprehensive title verification

- Technical inspection by qualified professionals

- Regulatory compliance verification

- Financial analysis and valuation

Phase 3: Final Verification (Week 4)

- Cross-verification of all findings

- Legal opinion from qualified advocates

- Final inspection and documentation

- Due diligence report preparation

Professional Services for Due Diligence

Legal Professionals

When to engage legal experts:

- Complex title issues or disputes

- Commercial property transactions

- High-value residential purchases

- Properties with legal complications

Technical Experts

Professional technical assessment:

- Structural engineers for building assessment

- Architects for compliance verification

- MEP engineers for systems evaluation

- Environmental consultants for site assessment

Financial Advisors

Financial expertise for:

- Property valuation and market analysis

- Tax planning and optimization

- Investment analysis and ROI calculations

- Financing options and loan structuring

Red Flags During Due Diligence

Document-Related Red Flags

- Missing or incomplete documentation

- Discrepancies in property details

- Suspicious alterations or corrections

- Reluctance to provide documents

Legal Red Flags

- Pending litigation or disputes

- Multiple ownership claims

- Regulatory violations or notices

- Encumbrances or liens on the property

Cost-Benefit Analysis of Due Diligence

Investment in Due Diligence

Typical costs for comprehensive due diligence:

- Legal Verification: ₹15,000 - ₹50,000

- Technical Inspection: ₹10,000 - ₹30,000

- Valuation Services: ₹5,000 - ₹15,000

- Total Investment: ₹30,000 - ₹95,000

Potential Savings

Due diligence can save you from:

- Legal disputes costing lakhs in legal fees

- Structural repairs worth several lakhs

- Regulatory penalties and compliance costs

- Loss of entire investment in fraudulent deals

Technology in Due Diligence

Digital Verification Tools

Modern technology aids in due diligence:

- Online property record verification

- Digital document authentication

- Satellite imagery for boundary verification

- Blockchain-based property records

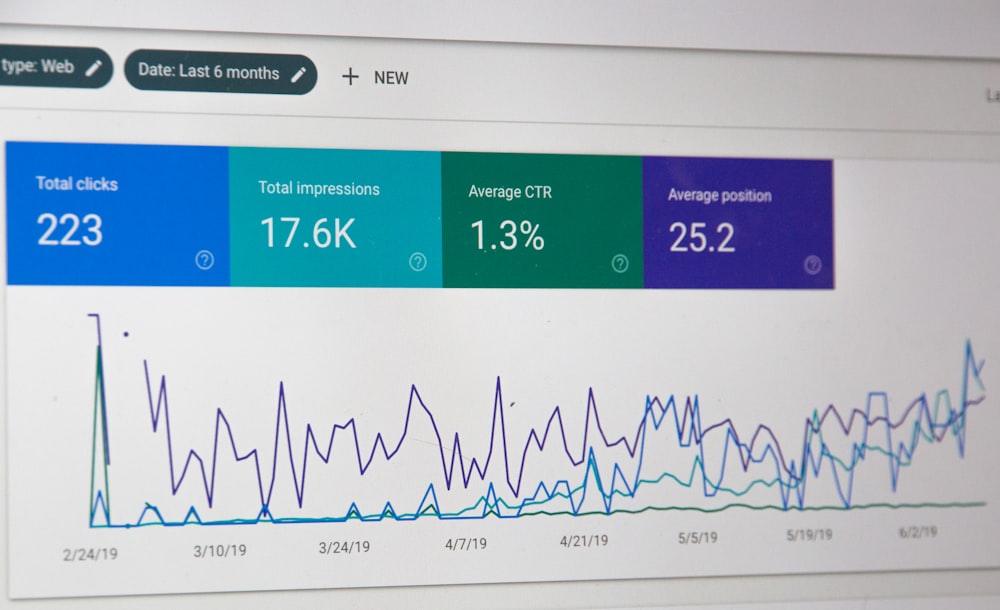

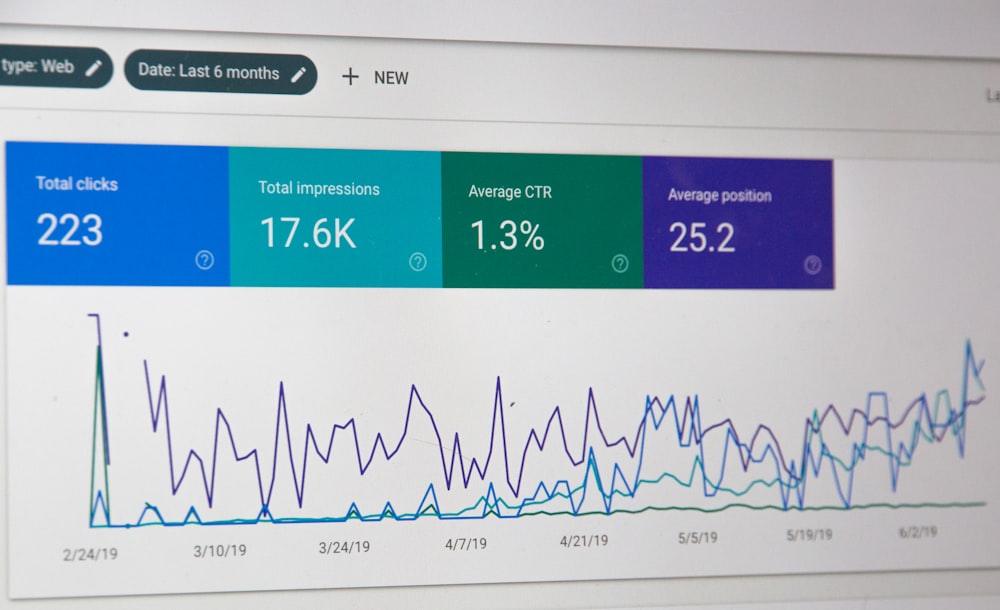

Data Analytics

Advanced analytics for better decisions:

- Market trend analysis

- Price prediction models

- Risk assessment algorithms

- Investment performance analytics

Common Mistakes to Avoid

Inadequate Due Diligence

- Rushing through the verification process

- Relying solely on seller-provided documents

- Skipping professional inspections

- Ignoring regulatory compliance

Over-reliance on Intermediaries

- Trusting brokers without independent verification

- Not engaging qualified professionals

- Accepting verbal assurances without documentation

- Failing to verify intermediary credentials

Conclusion

Due diligence is not an expense—it's an investment in your peace of mind and financial security. In Hyderabad's complex real estate environment, thorough due diligence is your best protection against fraud, legal complications, and financial losses.

The time and money invested in proper due diligence pale in comparison to the potential costs of dealing with problematic properties. Whether you're buying your first home or adding to your investment portfolio, never compromise on due diligence.

Remember, a property transaction is likely one of the largest financial decisions you'll make. Approach it with the seriousness it deserves, engage qualified professionals, and ensure every aspect is thoroughly verified before you commit.

Your future self will thank you for the diligence you exercise today. When in doubt, always choose caution over haste—there will always be other properties, but recovering from a bad purchase can take years.

Share this article

Legal Team

Legal Advisors

Our team of experts brings years of experience in the Hyderabad real estate market, providing valuable insights and practical advice for property buyers and homeowners.

Related Articles

December 15, 2024

November 20, 2024

September 18, 2024

Popular Tags

You May Also Like

Essential Home Inspection Checklist for Hyderabad Buyers

A comprehensive guide to what you should look for when inspecting a property in Hyderabad's unique climate and construction standards.

Understanding Property Registration Process in Telangana

Navigate the legal requirements and documentation needed for smooth property registration in Telangana state.

Red Flags to Watch Out for When Buying Property in Hyderabad

Common warning signs that could indicate problems with a property purchase in Hyderabad's real estate market.

Stay Updated

Subscribe to our newsletter for the latest home buying tips and market insights.